What do I do if I forget my password when I try to log in for the first time?

You can reset your password by clicking the “Forgot Password” link in the login box, or call our Member Contact Center for assistance at (888) 786-2791.

How do I request copies of my tax forms (1099s, 1098s)?

To obtain copies of your forms for tax purposes, please call our Member Contact Center at (888) 786-2791.

How much money will I need to bring to closing?

You will be provided with a "Closing Disclosure" form three (3)-days prior to your scheduled closing date. The "Closing Disclosure" will state the specific amount of funds that you are required to bring to closing in the form of a cashiers/bank check, made payable to the closing agent.

Can Google Authenticator, Authy, or Duo be used for St. Mary’s Bank mobile/online banking authentication?

Authenticate using a two-factor authentication application like Google Authenticator, Authy, or Duo are options to receive the Multi Factor Authentication (MFA) code. You will need to have an Authenticator App on your device and enable it in order to start using it.

- This process should be done using a browser on a desktop or laptop.

- Authenticator Apps can be downloaded from an App Store. Once completed, a verification code will be required, using email, text or voice, before the 2FA is completely added. Once confirmed, you will then have 2FA as an option for MFA.

If you have questions, or need assistance, please call our Member Contact Center at (888) 781-2791.

How do I change my address?

To change your address within online banking, navigate to settings and then select the contact tab. Click on the pencil icon to edit your address.

You may also visit any branch office, call our Member Contact Center at (888) 786-2791, or send us a secure message through online banking. You can also mail your request to:

- St. Mary's Bank Member Contact Center

- PO Box 990

- Manchester, NH 03105-0990

When is my credit card payment due and how is my minimum payment amount determined?

All credit card payments are due on the 21st of the month. The minimum payment amount due is 3% of the balance OR $30.00, whichever is greater.

How do I request a PIN (Personal Identification number) for Cash Access?

With all new accounts, PIN mailers are sent within the first few days of receiving your new credit card. PIN Mailers may also be requested anytime by contacting

(888) 786-2791. A PIN is required to have access to cash via any ATM. For your protection, keep your PIN separate from your card at all times and never share your PIN with anyone.

I have linked an external account, why can I not use it for transactions?

Adding an external account for viewing allows you to view transactions. If you would like to transact on the external account, you will need to add the account via the Transfer icon.

How do I set up an external transfer in online banking?

When you are in online banking, hover over 'Move Money' and then click 'Transfers'. (Click on “Transfer” directly if you are in mobile app)

- Transfers > under "More Actions" tab > click on “Add Account” > click "Add an account to transfer money" > click “Manually add external account” > enter external transfer account information then click "Continue" to complete.'

- The system will then generate micro deposits that will be sent to the other financial institution within 3-5 business days.

- Log into your other financial institution's online banking to retrieve micro deposit amounts.

- Once you have the micro deposit amounts, log back into St. Mary's Bank Online Banking app, under "Settings" then "Accounts", confirm external transfer account by entering in the micro-deposit amounts.

Once this is complete, you will be able to use the external transfer account.

Can I make additional payments to loan principal or interest?

Payment amounts are limited to your regular payment amount due at this time. Payment of another amount may result in a delay in the processing of your payment. If you wish to make additional principal-only payments, you can do so through our payment channels, by visiting a local branch, or calling our Member Contact Center.

How do I stop payment on a check?

You can stop payment on a check through online banking, by calling our 24-hour automated telephone banking at (603) 647-1177, or by calling our Member Contact Center toll-free at (888) 786-2791. A verbal stop payment on your account will be accepted by telephone, but you must sign and return a stop payment form, which you can pick up at any branch, within 14 calendar days of making the verbal request. The stop payment will be deleted from the system if the stop payment form is not signed and returned within 14 calendar days. A processing fee for each stop payment will be automatically deducted from your account. An accurate and complete stop payment is guaranteed after a 24-hour waiting period.

Will I be able to print a confirmation of my loan payment?

Yes. Once you make your loan payment online, you will be able to print the confirmation page by using the print option in your browser.

How do I enroll in My Credit Score?

Using St. Mary's Bank Online Banking or Mobile Banking app, you can enroll in My Credit Score by clicking the My Credit Score widget/banner.

What browsers are supported by online banking?

Online banking is supported by the two latest versions of all browsers.

What does my Payment Privilege cost?

There is no additional cost associated with this privilege unless you use it. You will be charged our overdraft per item paid fee of $32 for each overdrawn item created by a traditional paper-based check, a teller withdrawal, an automatic payment (ACH) transaction, or a recurring debit card payment. Also, if you have requested us to do so, we may authorize and cover ATM transfers or withdrawals and everyday debit card purchases. For example, three paid items in one day will result in a total of $96 in overdraft fees for that day. To help you manage your account, the total fees you have paid for items (both paid and returned) during the current month and for the year-to-date will be reflected on your monthly checking statement.

How do I grant shared access to my online banking?

- Access the Settings menu under "Tools & More

- Select the Shared Access tab

- Select the Add a User button

- Complete the following information:

- First and Last Name of individual member wishes to share access with

- Email address of individual member wishes to share access with

- Confirm the email

- Set permissions for each share or loan

- Select Save

- Confirm the permissions and agree to the terms and conditions

- Upon hitting Confirm, you will receive a success message and see that the invitation is pending. This action also sends an email to the recipient.

- You can click on the recipient's name to expand the selection:

- Code is listed here and you have 24 hours to provide it to the recipient before it expires and can no longer be used.

- You can edit the name and/or email address of the recipient. However, once the recipient has clicked the link in the email, this function will no longer be available.

- You can edit the permissions of the share/loan they selected at any time. You can cancel the invitation as long as it is before the recipient has clicked on the activation link.

I don’t have the ability to text on my phone. What can I do?

No text/no problem! The system can call you back with the verification code. Or, you may use an authenticator app.

Why can I not transfer to/from the external account I added?

If the external account has already been confirmed but not appearing on your Online Banking any longer, please contact the Member Contact Center at (888) 786-2791 for further assistance.

How do I check the status of a recent loan application?

To check the status of a consumer loan (home equity, credit card, personal loan, or vehicle loan) in progress,

click here.

What are some of the ways I can access my Payment Privilege limit?

The chart below shows the different ways you can access your Payment Privilege limit.

| Access points | is my overdraft privilege available? |

| Teller | Yes |

| Writing a Check | Yes |

| Debit Card (recurring) | Yes |

| ATM Withdrawal | Optional* |

| ACH | Auto |

| Debit | Optional* |

| Online Banking | Yes |

| Telephone Banking | Yes |

*Payment Privilege service will be made available for ATM or everyday debit card transactions upon request. Call (888) 786-2791 or visit one of our branches to arrange for your ATM and debit card coverage.

Who can I talk to about my late payment?

Please contact the Loan Resolution Department at

(603) 629-1345 for assistance.

Can I add my St. Mary's Bank cards to my mobile wallet?

Yes, all St. Mary’s Bank cards are compatible with wallet pay or mobile wallets.

How do I request copies of checks, statements, or deposits?

Sign up today and access your account history information online using our free Online Banking. You may also request research on your account(s) or obtain copies of your statements, checks, and deposits by contacting our Member Contact Center toll-free at (888) 786-2791.

What are the External Transfer limits?

Consumer Online Banking:

- Daily cumulative transfer limit (up to or equal to $5,000)

- Weekly cumulative transfer limit (up to or equal to $5,000)

- Monthly transfer limits (up to or equal to $25,000)

- Limits cannot be changed for any member

Basic Business and Business Cash Management Online Banking:

- Daily cumulative transfer limit (up to or equal to $10,000)

- Weekly cumulative transfer limit (up to or equal to $10,000)

- Monthly transfer limits (up to or equal to $100,000)

How can I change my PIN on my debit card?

You can change your debit card PIN by visiting a branch office or if you know your current PIN you can change it at any St. Mary's Bank ATM.

What types of Rewards are available?

The St. Mary’s Bank Rewards Program offers a variety of rewards ranging from gift cards, cash back in the form of a statement credit, merchandise, airline tickets, cruise travel, car rental certificates, hotel certificates and charitable giving. Rewards are subject to availability. To view a listing of sample Rewards,

click here or log in to your Online Banking account and navigate to the "Rewards" tab.

When will I be notified of the monetary amount required at closing?

Three (3)- days before your scheduled closing, you will receive a call from the settlement agent letting you know if you need to bring a certified check to the closing and exactly how much it needs to be.

What types of loans can I pay with an external account?

You can use an external account to make a payment on any consumer loan (Equity Line or Loan, Auto Loan, Personal Loan, Home Improvement Loan, Green Rate Loan, Credit Builder, Credit Builder Plus, Overdraft Line of Credit, or Credit Card).

This service is not available for mortgage or commercial loan payments.

How do I add or delete a signer from my account?

An updated signature card is required in order to add or delete someone from your account. You may visit a Sales & Service Representative at any branch office or you may contact our Member Contact Center toll-free at (888) 786-2791. A representative can accept your information over the telephone and mail you the necessary documentation.

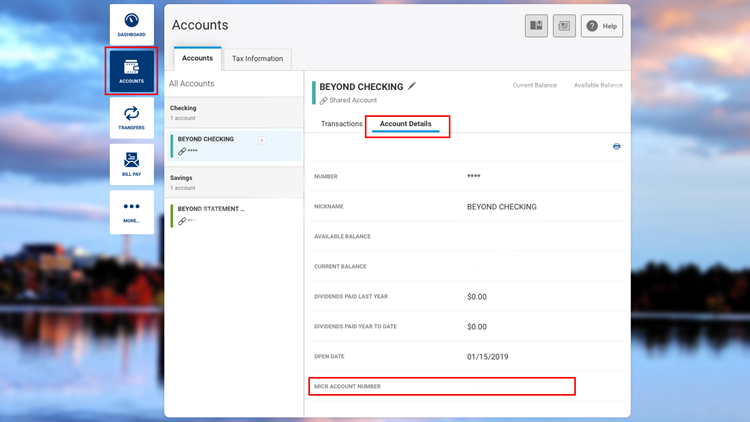

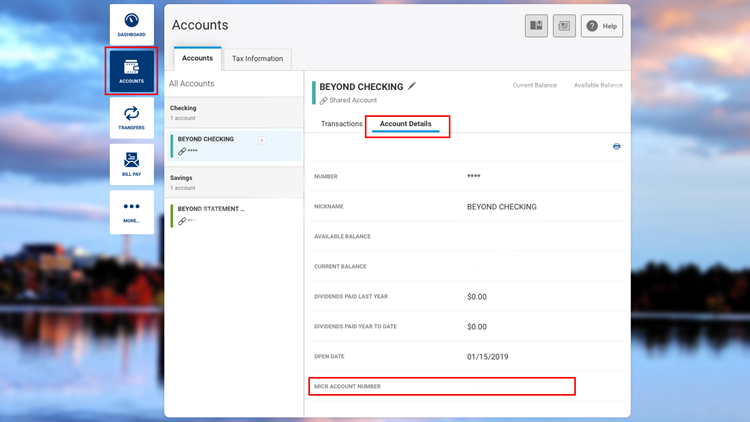

Where can I find my account number in online banking?

Login, then choose the account that you want to see the information for. Once you are in the account go to the account detail. There you will have access to your account number.

How often does My Credit Score get updated?

If you regularly access digital banking, your credit score will be updated every 7 days. You may also refresh your credit score and full report every 24 hours by clicking “Refresh Score” and navigating to the detailed Credit Score Dashboard within Online/Mobile banking.

I have an international phone number. Can it be used?

While an international phone number cannot be used, the alternative is to use an authenticator application like Google Authenticator.

How soon can I use my Payment Privilege?

If you are a new member, you may be able to use the Payment Privilege service 30 days after your account is opened, assuming your account is in “good standing”.

What will I have to bring to closing other than the amount needed to cover closing costs?

A picture identification, copy of your insurance binder (or existing policy) with a paid receipt and a certified check for any monetary amount required.

Should I update my email address as well, or remove it if it will not be used?

Yes, update your email address and always keep it current. While email will not be used for security verification, it will be used to send you secure messages, notice when your eStatement is ready, and other communications.

What is my Cash Advance/ATM limit and are there fees for a Cash Advance?

The cash advance limit is 50% of the credit line assigned to the credit card account. The minimum required for a cash advance is $50.00. The fee is either $10.00 or 4% of the total amount of each cash advance, whichever is greater. The ATM withdrawal max per day limit is $600.00. The bank withdrawal max per day on cash advances is $3,000.00

How do I create an external payment account?

To create a external payment account, click the Register button. Submit your name and email address. Then, you will be prompted to submit your member number, last 4 of your social security number, and your date of birth. Finally, you must agree to the Terms of Service.

How should St. Mary's Bank be listed on the homeowners insurance?

The correct wording is as follows:

St. Mary's Bank, Its Successors and/or Its Assigns, As Their Interest May Appear

c/o Loan Servicing

48 Perimeter Road

Manchester, NH 03103

Is there a processing fee to make a payment using an external account?

Effective February 1, 2020—A $2 transaction fee applies when making a one-time payment from an external account at another institution. There is no fee to set up recurring payments.

Why is the nation's first credit union called "St. Mary's Bank?"

The word "Bank" in our title, is the result of the literal translation of our founding French name La Caisse Populaire (meaning "the people's bank") Ste. Marie, by the New Hampshire Legislature.

How quickly can you close on a mortgage loan?

Typically, you can close your mortgage loan within 45 days of application, depending on the time of year and the type of transaction. We can sometimes close sooner than that, depending on the transaction and the timeliness of information and documentation provided.

Do I need to create an account to make a loan payment from an external account?

You can register and create an account for added convenience when making future payments, or you can choose “Express Pay” if you would like to make a payment without creating an account.

Do you offer rate locks on mortgages? For how long? Does it cost extra to lock in?

We do offer rate locks on residential mortgages, for almost any term needed: 30-, 45-, and 60-day locks, or longer. Additional fees and/or higher rates may apply for locks in excess of 30 days. Please call one of our mortgage representatives at

(888) 705-9596 to get more information.

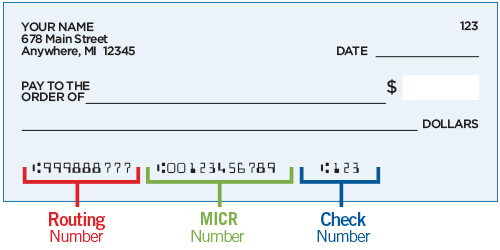

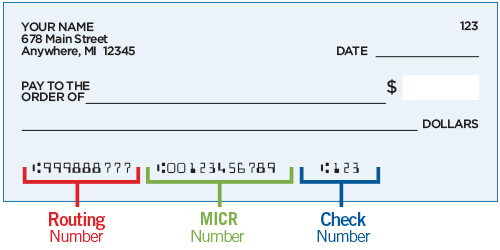

What is my MICR number?

Your MICR number is a 13-digit number that is associated with your specific account. This number is used to set up electronic payments. You can find your MICR number in Online Banking as shown below:

OR

If you are making a payment or transfer, or setting up direct deposit, you will need your MICR number and St. Mary's Bank's routing number. St Mary's routing number (also known as the Transit or ABA number) is 011400149.

What is the difference between my member number and account number?

Your member number is used to identify your overall relationship with St. Mary's Bank. Your account number is used to identify a specific account within your relationship.

What if I don’t opt in to continue Payment Privilege on ATM or everyday debit card transactions?

If you do not opt in to Payment Privilege, any ATM or everyday debit card transactions that exceed your available balance may be declined.

Will I get a copy of the appraisal?

Yes, we will provide you with a copy of your appraisal as soon as it is available.

What is the difference between current and available balance?

Current Balance is the outstanding balance of your Cash in Bank. This is the balance after all banking transactions have been made. Available Balance refers to the portion of the current balance that is available for withdrawal.

Is there a way to avoid overdrafts in the first place?

The best way to avoid overdrafts and fees is to keep track of your account balance by entering all checks, debit card purchases and ATM withdrawals in your check register, reconcile your check book regularly and manage your finances responsibly. We also offer a variety of online tools to help you manage your finances and avoid overdrafts. If you haven’t done so already, sign up for Online Banking and Bill Pay for easy tools to manage your finances online. However, if a mistake occurs, St. Mary’s Bank offers additional ways to cover overdrafts** in addition to Payment Privilege. Other options include:

- Good account management $0

- Link to savings account $2 per sweep

- Overdraft line of credit $25 Annual Fee

- Payment Privilege overdraft per item paid $32

How do I contact St. Mary's Bank?

By phone: St Mary's Member Contact Center toll free at (888) 786-2791

By Mail:

- Member Contact Center

- St. Mary's Bank

- PO Box 990

- Manchester, New Hampshire 03105-0990

What if I do not want to have Payment Privilege on my checking account?

What are the limits for Remote Deposit?

The following limits apply for remote deposit: $10,000/day or $20,000/month or 20 items per month.

How do I report card fraud?

If your, debit or credit card is lost or stolen, please report it immediately. Prompt reporting will help avoid unauthorized charges to your account. You have four contact options.

- Online & Mobile Banking: Within Tools & More, the primary accountholder may access card management to block the card.

- Member Contact Center: (888) 786-2791 Available Mon-Fri 8am – 5:30 pm, Sat 8am – 12pm

- Card Support Center: (877) 268-2612 Available 24/7 (Closed Thanksgiving and Christmas)

- Outside of US: (909) 941-1398 Need to dispute charges on your debit or credit card?

- Call Card Dispute Support: (877) 504-3009 Available 24/7 (closed Thanksgiving and Christmas)

I have multi-factor authentication on my email account, so it’s secure. Is that enough?

It’s great that you have that in place. Unfortunately, as we have no control over enabling multi-factor on our member’s personal email accounts using a phone call, text, or authenticator app for verification is a more secure approach for our members. A multi-layered approach of something you know (username and password) and something you have (phone) is more secure. Ultimately, it is beneficial to our membership, minimizing losses, and further protects our members’ financial accounts. Protecting your account is our priority.

How do I set up connection with my external bank account for viewing balance and history?

When you are in online banking, hover over 'Move Money' and then click 'Transfers'. (Click on “Transfer” directly if you are in mobile app)

- Transfers > under "More Actions" tab > click on “Add Account”

- Click "Add an external account to view balances and transactions”

- Find your external financial institution > agree to terms and conditions

- Enter you external financial institution login credentials and complete any required verification

- Select the external bank account that you want to add

- Click “Save and Finish” to complete the process.

Who do I contact if I have questions about my Credit Card?

Please contact the Member Contact Center at

(888) 786-2791. Or you can access your credit card account in online banking to make payments, view transactions and statements, setup alerts and use other features.

What do I do if I forget my user name when I try to log in for the first time?

On the online banking login screen, you are able to click on “Forgot Username” option to retrieve your username. You can also call our Member Contact Center for assistance at (888) 786-2791.

Is there a fee to enroll/use My Credit Score?

No. It's entirely free, and no payment information is required to register.

I'm a new member, how do I set up Online Banking?

On our website, click on “Online Banking Login”. On the login page, please use “Register a New Account” to set up your online banking. You can also contact our Member Contact Center at

(888) 786-2791 or

visit any branch location to register you for online banking.

What is the grace period to make changes to my CD/IRA when it matures?

After your CD/IRA matures, you have a 10-calendar day grace period to make changes to your account.

How do I reorder checks for my checking account?

For the easiest and fastest method, reorder personal checks online. You can also order checks through online banking, by calling our Member Contact Center toll-free at (888) 786-2791, mailing your reorder form to us, or dropping it off at any of our branch locations.

I am interested in applying for a loan with St. Mary's Bank. I'm self-employed. Will you need to see my tax returns?

Generally, we will request that you provide two years of tax returns if you are self-employed.

Can I receive my statement electronically?

If you are enrolled in paper statements for your account, your credit card statement will generate as paper - if you are enrolled in eStatements, the credit card statement will default to electronic. You may enroll in eStatements for your account via Online Banking. Just log in, click the "eStatements" tab, and accept the Terms and Conditions. An email notification will inform you when your eStatement is ready to view. You may request to receive your credit card statement separately at no charge by calling the Member Contact Center at

(888) 786-2791 or stopping in at any

branch location.

How do I know when I use the overdraft limit?

You will receive an overdraft notice each time items are paid, including fees. You will need to subtract the total fees when balancing your checkbook.

What if I need to dispute a loan payment made from an external account?

Please contact the financial institution where your external account is held.

How do I redeem and view my Reward Points?

To redeem and view your Rewards points, please log in to Online Banking and click on the Card Rewards widget or contact our Rewards Center at

(800) 816-3923. Our Rewards Center is available 7 days a week 9:00 AM to 9:00 PM Eastern Standard Time ‐ excluding federal banking holidays and subject to some restrictions.

Do you offer mortgage loans to purchase second homes?

We do! We offer second and vacation home financing. We can also finance three-season homes and summer cottages with one of our portfolio programs. To find the mortgage program that best meets your needs, please contact one of our mortgage representatives at

(888) 705-9596.

What is my Payment Privilege limit? If I have two checking accounts, can I get Payment Privilege on both?

Locate your account type below and make note of the corresponding limit. If you have multiple accounts for your household, you may have a limit on all eligible accounts.

- Beyond Checking $300

- Beyond Rewards and Beyond Interest Checking $500

Can I make a loan payment from an external account if I already have an AFT on my loan account?

Yes, but you must contact us first to cancel your automatic funds transfer to avoid duplication of payments.

How do I report identity theft and fraud?

If you feel your account and/or ID has been compromised take the following steps

outlined here.

Why do I keep getting locked out of Online Banking?

Please make sure the correct information is being entered when logging into Online Banking. Contact the Member Contact Center at (888) 786-2791 to see if there are any other known issues happening with your account.

How does Payment Privilege work?

As long as you maintain your account in “good standing,” we may approve your overdraft items within your current available Payment Privilege limit as a non-contractual courtesy. For overdraft privilege consideration, your account is in “good standing” if you (1) make sufficient deposits to bring your account to a positive end-of-day balance at least once every 30 calendar days (including the payment of all credit union fees and charges); (2) avoid excessive overdrafts suggesting the use of Payment Privilege as a continuing line of credit; (3) Not being in default on any loan or other obligation with St. Mary’s Bank; and (4) there are no legal orders, levies or liens against your account. Please note that the amount of the overdraft plus our overdraft per item paid fee of $32 will be deducted from your overdraft limit. If the item is returned, the overdraft per item return fee of $32 will be deducted from your account. No interest will be charged on the overdraft balance. Please refer to the member overdraft policy for additional details.

What are the repayment terms for a home equity line of credit?

For Traditional Home Equity Line of Credit:

- During the first ten years of your equity line of credit (the draw period), you will be billed monthly for the interest due on your loan balance. After the ten-year draw period, we will work with you to convert your line of credit into an equity loan, during which time the principal and interest will be repaid over a ten year time frame.

For Home Equity Line of Credit with Lock Option:

- During the first ten years of your equity line of credit with a lock option loan (draw period), you will be billed monthly for the interest due on your loan balance. At any time during the draw period you may choose to lock any or all of your line into a fixed-rate advance. You will choose the term of the advance and pay it back just like a fixed-rate loan. These fixed payments will be in addition to any interest payments due on any balance that is not locked.

- As you pay down your balance, your available credit will increase. You can have 3 fixed-rate advances in one year and at any one time, and 10 over the life of the loan. After the ten year draw period, your line of credit will be converted so that no further advances will be available and you will be billed monthly principal and interest payments to repay your balance over a 10 year time frame.

How do I enroll in eStatements?

It's fast, easy and free to sign up. Simply log in to your Online Banking. Hover over the 'Quick Access' tab and click 'eStatements'. Accept the service terms and conditions and you will be enrolled. An e-mail notification will inform you when your eStatement is ready to view.

Will I have to answer security questions every time I log in?

The first time you log in to online banking, you will be required to verify security information. However, if you do not wish to verify that information every time you log in, you may choose to Remember this Device if it is a computer or device you trust and plan to use regularly.

What is Payment Privilege?

Payment Privilege is a discretionary overdraft service requiring no action on your part that provides you a safety net up to an automatically assigned overdraft limit. Your Payment Privilege limit may be available for checks, ACH and other transactions made using your checking account number or recurring debit card payment. Also, at your request, we may authorize and pay ATM transfers or withdrawals and everyday debit card purchases using your limit.

Why does it take so long for an external transfer to process?

There is a hold on incoming credit postings of 2 business days to monitor for any possible returns.

How long does it take to post the payment to my loan if I make a payment from an external account?

Payments received prior to 7:00 p.m. Eastern time are applied to the loan on the same business day. Payments received after 7:00 p.m. Eastern time will be applied to the loan on the following business day.

Where do I mail my Credit Card payment?

Mail your payment – including remittance coupon to:

St. Mary's Bank

PO Box 720

Manchester, NH 03105-0720

Ensure you include your account number to avoid delays in processing.

What payment options are available?

Payments may be made through any of the following options:

- Log in to Online Banking and transfer funds from your deposit account to your credit card account

- Automatic Payments - Set up a recurring transfer in your Online Banking, or by calling the Member Contact Center at (888) 786-2791 or completing the Recurring Payment Enrollment Form

- Mail to the remittance address provided on your statement

- Pay by Phone - contact St. Mary's Member Contact Center (888) 786-2791 (fee may apply)

- Automated Telephone Banking - call (603) 647-1177

- Drop by any St. Mary's Bank branch location

- Pay through St. Mary's Bank, or another financial institution's Bill Pay. - Make a payment using an external account through Pay Now

I made a payment from an external account, but it does not reflect on my loan, should I be concerned?

No, please allow one business day for the payment to be reflected on the loan. If you still have questions or concerns, please call our Member Contact Center at (888) 786-2791, or visit any of our branch locations.

What are the Bill Pay limits?

Consumer:

- $1,900 per transactions / $3,800 per day when using the payee's routing and account number at their financial institution

- $2,500 per transaction when using the payee's email address to send a person to person payment

- Payments to business are $25,000

Business:

- $2,500 per transaction, per day

- $400 per transactions / $800 per day to send a person to person payment

- Payments to businesses are $25,000

- Note: This is an institutional limit and therefore cannot be changed per member. If a higher limit is needed, consider sending payments over multiple days.

Is there an Annual Fee associated with my St. Mary’s Bank Credit Card?

There is no Annual Fee with a St. Mary’s Bank Credit Card. Please see the Account Terms and Conditions for more information.

Can I use Online Banking with my personal finance management software?

Yes, Online Banking allows Members to download their account information into the following finance management software applications:

- Intuit Quicken

- Intuit QuickBooks

Who can see eStatements in Online Banking?

Only the primary account holder can view eStatements in Online Banking.

I have forgotten my debit card or credit card PIN. Can I request a PIN reminder?

If you have forgotten your debit card or credit card PIN, you may request a PIN mailer reminder at any

branch office or by contacting our Member Contact Center at

(888) 786-2791.

I already have overdraft protection on my account. Should I still opt in?

The service we provide you through Overdraft Protection is separate from the Payment Privilege for ATM and one time debit card transactions service that can be added to your account. When a debit card transaction exceeds your available balance, your St. Mary’s Overdraft Protection is used first to cover the overdraft. Payment Privilege would only be used if funds are needed beyond what is available through your Overdraft Protection.

How do I get Mobile Banking?

To access mobile banking, download our Mobile Banking app from the Apple App Store or Google Play, then login with your existing online banking credentials.

Will enrolling, or accessing My Credit Score 'ping' my credit and potentially lower my credit score?

No. Checking your credit score on My Credit Score is a "soft inquiry" that does not affect your credit score.

How much are mortgage closing costs?

Mortgage closing costs vary, depending on the type of transaction (purchase or refinance), size of the loan and whether or not you are paying "points”. Additional services such as legal review of a trust or, power of attorney and other ancillary services may add to the fees that we charge as these services add to our costs to process and approve your loan.

How do I transfer a balance to my St. Mary’s Bank Credit Card?

Transferring a balance is simple. Contact (888) 786-2791 and provide the payee name, address, account number, and balance you wish to transfer. The minimum transfer amount is $250.00. Transfers cannot be made to Cash, Self, or other St. Mary’s Bank accounts. Each Transfer is subject to a fee of $10 or 3% of the transfer amount, whichever is greater. Please see Account Terms and Conditions for more details.

You may also use our online banking Credit Balance Transfer Form. There are two options through online banking. Begin by logging into your online banking and following one of the below steps from the online banking dashboard.

- First Option: Navigate to Tools & More on the menu items at the top of the dashboard page. Select the Member Forms option. Then select Credit Card Balance Transfer. Fill out the form and then submit.

- Second Option: Navigate to Move Money on the menu items at the top of the dashboard page. Select the Credit Card Balance Transfer option. Fill out the form and then submit.

Who is eligible to join St. Mary's Bank?

Membership is open to anyone with the purchase of one share of capital stock for $5.

What is St. Mary's routing/ABA number?

St. Mary's routing number (also known as the Transit or ABA number) is 011400149.

Where can I find my member number in Online Banking?

Hover over “Tool & More” > click on “Settings” > Member Number is under Profile Information section.

What's the difference between a bank and a credit union?

A credit union is a nonprofit, cooperative financial institution owned and run by its members. A bank issues stock and is owned by its stockholders who may not necessarily be its customers. Organized to serve, democratically controlled credit unions provide their members with a safe place to save and borrow at reasonable rates. Credit unions are "Not for profit, not for charity, but for service." Like credit unions, banks accept deposits and make loans - but unlike credit unions, they are in business to make a profit. Banks and savings & loans are owned by groups of stockholders whose interests include earning a healthy return on their investments.

What is the Voice of the Member Program?

We have implemented a member feedback process to monitor our performance and make improvements as needed. You may receive an invitation from our partner, Customer Service Profiles (CSP), to complete an online survey regarding your recent experience with us. Participation in this program is voluntary and joining does NOT require you to submit any personal account information. If you wish to speak with someone from St. Mary's Bank regarding this program, please contact our Member Contact Center at

(888) 786-2791.

How do I transfer funds from one account to another?

The easiest way to transfer funds between your St. Mary's accounts is to use Online Banking, our free, secure online banking service. With Online Banking, you can transfer funds on a one-time basis or establish recurring transfers on a weekly, semi-monthly or monthly basis. Other options for transferring funds between your St. Mary's accounts are calling our 24-hour automated telephone banking service at (603) 647-1177, calling our Member Contact Center toll-free at (888) 786-2791, or visiting any branch office and speaking with a Member Service Representative.

Do you offer mortgage loans to purchase investment property?

Yes, we offer mortgage loans for investment property. Our most popular program for 1- to 4-unit investment properties allows for a relatively low down payment and no points. We also offer financing for large, multi-unit properties (5+ units) and mixed-use properties through our commercial lending division – call

(603) 629-1540.

What if the information provided by My Credit Score appears to be inaccurate?

Each credit bureau has its process for correcting inaccurate information, but you can "File a Dispute" by clicking on the "Dispute" link within the My Credit Score credit report.

How do I get a copy of my credit report?

The Federal Trade Commission has posted a blog article "Credit Reports are now free, every week," reporting that the three national credit reporting agencies—Equifax, Experian, and TransUnion—will provide free weekly credit reports via the www.AnnualCreditReport.com portal through April 2021. The Commission advised the three reporting agencies are making the free reports available to allow Americans who may be anxious about their financial well-being during the COVID-19 pandemic. Y

ou may also request research on your account(s) or obtain copies of your statements, checks, and deposits by contacting our Member Contact Center toll-free at (888) 786-2791.

How do I send a message in Online Banking?

Once logged in, navigate to “Tools & More” and then select “Message Center”. Click on “Compose” to start a new message, and click on “Send Message” once you have composed a message.

How do I unlock my Online Banking?

Please contact the Member Contact Center at

(888) 786-2791 for assistance.

I have my vehicle financed with another bank. Can I refinance with you?

Yes, you may refinance your car loan through St. Mary's Bank. Receive a 0.10% discount off your interest rate when you register for Automatic Funds Transfer (AFT) from your St. Mary's Beyond Checking Account.

Click here to see our Consumer Loan Rates.

What is credit life and disability insurance and why do I need it?

Credit life and disability insurance can provide valuable financial security to you and your family if an illness occurs that keeps you out of work or in the event of loss of life.

My salary is commission based. Will you need to see my tax returns?

We may ask you to provide two years of tax returns as we consider your loan request.

Why doesn’t my account number work to enroll in Online Banking?

To register a consumer account you will need: member number, full Social Security Number, e-mail address listed on file, and either date of birth or zip code on file.

To register a business account you will need: member number, e-mail address on file, zip code on file, and Tax ID number.

How do I allow my family member to transfer funds into my account?

Your family member can utilize the member to member transfer option.

Can I overnight a payment?

Overnight payments can be made. Payments will need to be sent to the following address and members are responsible for the cost of sending payments overnight. Ensure you include your account number to avoid delays in processing.

St. Mary's Bank

Attn: Loan Servicing

48 Perimeter Road

Manchester, NH 03103

What is a charge-back notice and what does it mean?

This is notification that an item deposited into your account has been returned for some reason, typically for non-sufficient funds (NSF). The notice states the amount of the item deposited and the date the deposit was made. There is a processing fee for all items returned. If "WV" appears next to the fee, it means that the fee has been waived and the item has been re-deposited for you.

How will I know if my external account payment was successful?

For loan payments from an external account at another institution, you will receive an emailed confirmation.

What do I need to make my payment with an external account?

To pay with an external account, you’ll need your member number, first name, last name, the last four digits of your Social Security number and your date of birth. You will also need to provide an email address for payment confirmation.

What should I do if I am traveling and plan on using my St. Mary’s Bank Credit Card?

Let us know your travel plans beforehand to ensure access to your credit card is not interrupted. Transactions outside your normal purchasing pattern can be flagged for suspicious activity through our fraud protection services.

Benefits of submitting a travel notice:

- Protects against fraud

- Helps to ensure card usage is not interrupted

- Travel with the convenience of using your credit card

To submit a travel notification, you may send a secure message through online banking or by contacting Member Contact Center at (888) 786-2791.

In order to submit a travel notification through online banking, login to your online banking and follow these steps:

- Navigate to Tools & More on the menu items at the top of the dashboard page. Select Message Center.

- Once in the Message Center, select Compose.

- A panel stating New Message will appear. Select the drop-down menu under Subject and select Travel Notification. Fill out this form and then press Send Message.

Can I download my credit card transactions with Quicken or QuickBooks?

You may download your credit card transactions into Quicken.

I have Online Banking, but I can’t log in; why?

If you have not accessed your St. Mary’s Online Banking for an extended period of time, you will need to reregister. Please call our Member Contact Center at (888) 786-2791 or visit any branch for assistance.

How do I add authorized users?

Authorized users can be added by calling the Member Contact Center at

(888) 786-2791. You must provide their name, date of birth, social security number, address, and relationship to the primary account holder.

How can I change the PIN on my credit card?

If you know your current PIN, you can change your credit card PIN at any of St. Mary's Bank's ATMs. The only way a member can get a new PIN is by receiving a PIN Mailer.

Where can I find St. Mary’s Payment Privilege policy?

What is a Visa Secured Credit Card?

A secured credit card uses money you place in a savings account which is used as collateral. Your credit line is based on your income, ability to pay, and the amount of your collateral deposit. A secured credit card is good for members who are new to credit, or for members who are just starting out or rebuilding credit after a major life event such as divorce, job loss, or serious illness.

Do you offer “portfolio” mortgage loans?

Yes, as a credit union, St. Mary's offers a wide variety of portfolio loan programs for non-conforming properties and other situations where more flexible lending guidelines may be appropriate.

Do you have special first-time home buyer mortgage programs?

Yes, we have many programs to meet the needs of first-time buyers. Our Welcome Home Program helps buyers with low to moderate income levels offering low rates and down payment requirements. In addition, we participate in New Hampshire Housing, FHA, and several other programs designed to meet the needs of first-time homebuyers. We also offer free prequalification by phone or in person to potential homebuyers to determine the best mortgage programs to fit their specific home buying needs.

Can I apply for a credit line increase?

Members are required to complete a new application for a limit increase by calling the Member Contact Center at

(888) 786-2791, visiting a branch or applying online via online banking. If the credit card account is joint, both owners need to apply (authorized users are not able to request an increase). Only the primary applicant can make a request on business credit cards. Limit increases go into effect within 24-48 hours of approval.

Where can I learn more about credit unions?

You can visit these sites:

How quickly must I repay my Payment Privilege?

You should make every attempt to bring your account to a positive end-of-day balance as soon as possible, and must do so within 30 calendar days. If you are not able to do so, you will receive a letter from St. Mary’s Bank informing you that your Payment Privilege limit has been suspended and additional items will be returned.

Will this score be used when I apply for loans with St. Mary's Bank?

No, St. Mary's Bank uses our lending criteria when making final loan decisions. Credit will be pulled as part of the underwriting process.

Why can’t I see a transaction that I made to a linked external account?

The information in your linked external accounts is not always real time and may take up to 24 hours to display and may require you to re-enter your credentials to sync your external account transactions.

How do I check on, or request a history on my account?

To obtain specific account information, please call our 24-hour automated telephone bank at (603) 647-1177 or contact our Member Contact Center at (888) 786-2791. If you are currently a member of St. Mary's, you can use our free Online Banking service, which allows you to access your financial information any time.