Go big or go home? With our jumbo loans, you can do both – secure the spacious, high-end property you've always wanted and make it your home. Our Jumbo Loans offer maximum financing flexibility with competitive rates and quick turnaround for your New Hampshire, Massachusetts, or Maine home purchase.

- Low down payment requirement

- Loan amounts of $766,551 to $1.5M

- Fixed-rate and adjustable-rate options

- Convenient local processing, underwriting and servicing

- 95% financing available for single-family primary residence properties

- Financing available for single-family primary residence, second, condominiums, and PUD homes

Apply for a Jumbo Mortgage

Have a Conversation

Explore

See All Posts

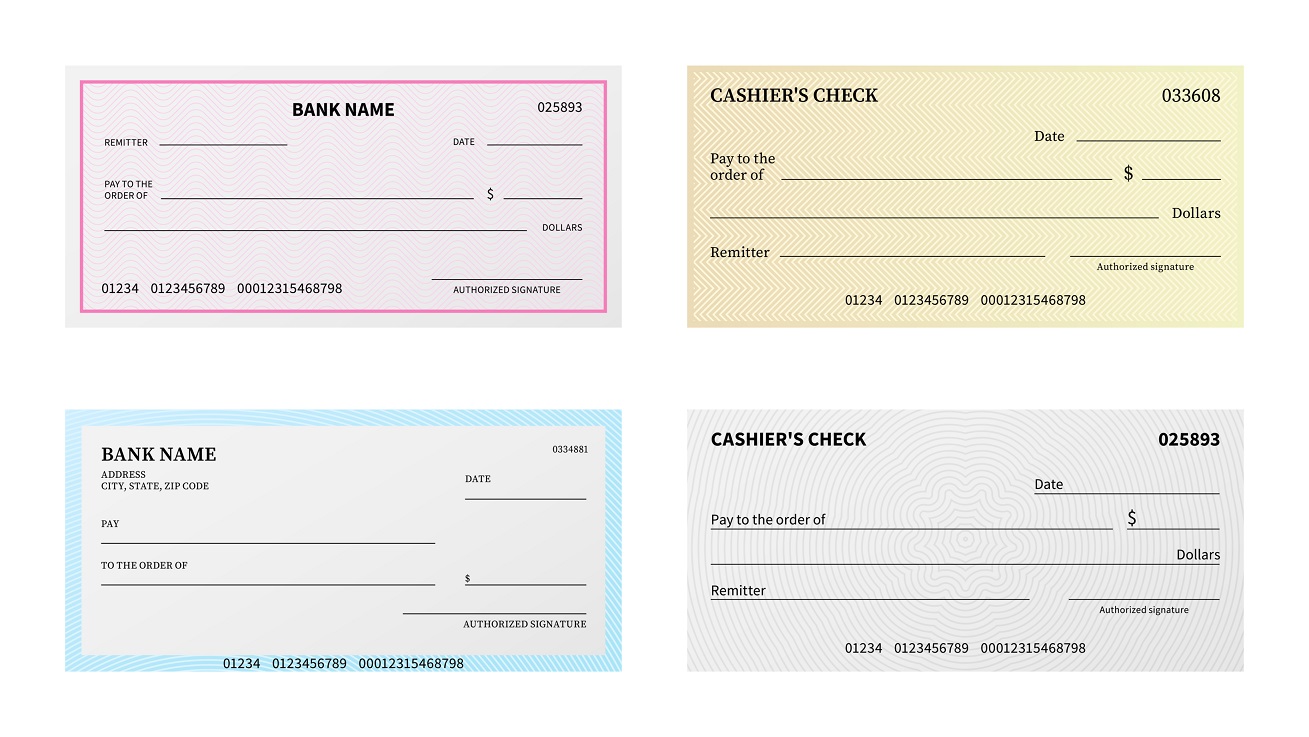

How to Spot Fake Check Scams: Protect Yourself and Your Finances

Team News

Tina M. Brown Joins St. Mary’s Bank as Business Development Team Lead

Team News

St. Mary’s Bank Promotes Sanela Zulic to Vice President, Regional Manager North

Disclaimer:

Jumbo loans available for single-family residential, condos and PUDs (seasonal, investment, multiunit and manufactured homes not eligible) in New Hampshire, Massachusetts, or Maine. Second homes are required to be suitable for year-round use, utilities, and property access; property must possess adequate plumbing, heating & cooling systems, and electrical services. Any property that is not suitable for year-round occupancy, regardless of location, is unacceptable for this loan type. Max. Loan To Value (LTV) 95% with (Private Mortgage Insurance) PMI, max LTV without PMI 80%. Second home loan amount will vary based on LTV and/or property type. Limited Cash Out Refinance max. LTV 80%, Cash Out Refinance max. LTV 70%. PMI required on all loan transactions with LTV greater than 80%. Rates will depend on specific characteristics of loan transaction and credit profile up to closing date.