How to Spot Fake Check Scams: Protect Yourself and Your Finances

Fraudsters are becoming even sneakier with their scams, and one of the most common is the fake check scam. Whether you're selling items online or looking for gig work, it's crucial to understand that you could be a potential target. Being able to recognize the signs of a fraudulent check is not just important, it's a necessity. Here's how you can spot fake check scams and protect yourself from falling victim to these cons.

What is a Fake Check Scam?

A fake check scam occurs when a fraudster sends you a counterfeit check, often for an amount larger than expected, and asks you to deposit it. They then request that you wire or send back a portion of the funds, usually under the guise of covering fees, services, or other expenses. Once the bank discovers the check is fake, you're left responsible for the entire amount, which can lead to a significant financial loss. You’re essentially the middleman in their fake check scam, and the consequences can be devastating.

Common Scenarios for Fake Check Scams

- Overpayment Scams: This often happens when selling something online or through Facebook Marketplace. The scammer sends a check for more than the agreed price and asks you to refund the difference.

- Lottery or Prize Scams: You receive a check claiming you’ve won a lottery or prize but must pay fees or taxes upfront.

- Work-from-Home Scams: You get a check as part of a job you applied for online, often for gig or freelance work, and are instructed to use part of the money for supplies or other expenses.

- Car Wrapping or Decal Scams: This scam occurs after you respond to a car wrapping advertisement. The fraudulent company asks you to deposit a check and send money to the installers. However, the service isn’t legitimate, and you’re stuck without a car wrap and without your money.

- Remote Deposit Scams: Another method of check deposit fraud is when someone takes a photo of a check. These are often sent digitally for remote deposit. Remember that image copies or photos of checks emailed or otherwise received for deposit are non-negotiable and not valid nor accepted for deposit.

Red Flags to Watch For

- Unexpected Checks: Be cautious if you receive a check out of the blue, especially if you haven't requested it.

- Pressure to Act Quickly: Scammers often create a sense of urgency. They could threaten a loss of prize money, say they’re hiring someone else for the job, or increase the price for services. The purpose is to urge you to deposit the check and wire money immediately before you have time to stop and think.

- Poor Quality Checks: Fake checks might have typos, poor printing quality, or odd bank names. Photos of checks are NEVER valid nor accepted for deposit.

- Requests for a Portion of the Money: Be wary if you're asked to send money back after depositing a check.

- Too Good to Be True: If the amount is considerable or the deal seems too good, it’s likely a scam. Fraudsters depend on your financial situation and desire for more money or a good deal to sneak by your senses.

Real-Life Examples

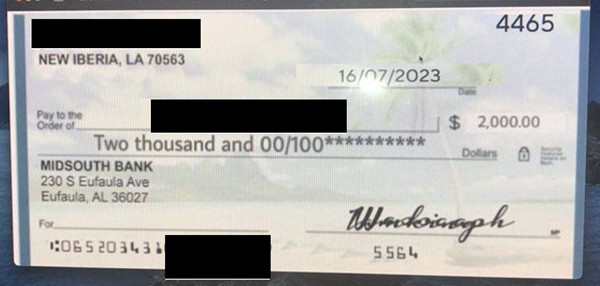

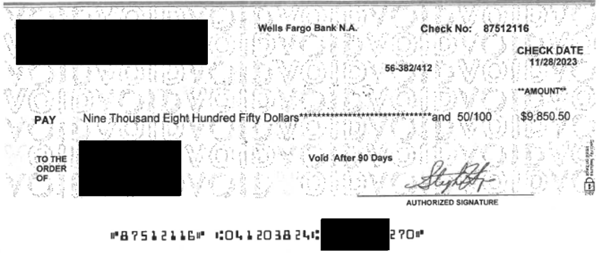

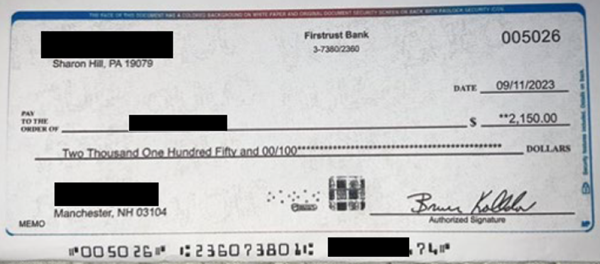

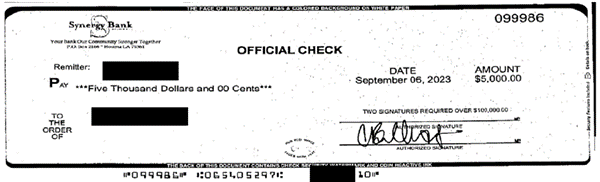

To help you spot these scams, we have compiled photos of fraudulent checks from various scam scenarios, including gig work and overpayment schemes. These are real-life examples that the St. Mary’s Bank Risk team has witnessed firsthand. They highlight common features of fake checks, such as unexpected winnings, inconsistencies in the printing, and the use of generic templates.

Overpayment Scam. This check was received for selling something online, with instructions to send the overpayment money somewhere else.

Lottery Scam. This check was received in the mail and presented to the resident as lottery winnings.

Work-from-Home Scam. This check was received for an online job. The receiver of this fake check was supposed to buy supplies and then send the rest of the money elsewhere.

Car Wrap Scam. The receiver of this fake check was supposed to wrap his car with an advertisement and use this money to pay the "wrapper” for the service.

Remote Deposit Scam. This digital image of a check received from a Snapchat "friend" was remotely deposited.

How to Protect Yourself

- Verify the Source: If you receive a check, verify its legitimacy by contacting the issuing bank directly using contact information from their official website.

- Use Secure Payment Methods: Use secure, traceable payment methods for online sales or gig work and avoid accepting checks from unknown sources.

- Report Suspicious Activity: If you suspect a scam, immediately report it to your bank or credit union and relevant authorities.

Staying informed and cautious is your best defense against fake check scams. Always question unexpected checks, be careful of high-pressure tactics, and verify any requests for money. By following these guidelines and learning from real-life examples, you can protect yourself from becoming a victim of these fraudulent schemes.

If you ever have questions about a check you've received, don't hesitate to call our Member Contact Center at 1-888-786-2791 for assistance.